Related News

Choose lithium battery for forklifts

There are increasing demands of advanced lithium battery for forklift industry recently, therefore we would suggest how to choose a right lithium battery for your forklifts!

Wide Application of Lithium Iron Phosphate Batteries in Forklifts

How much do you know about the application of lithium iron phosphate batteries in electric forklifts?

CeMAT Asia Exhibition at Pudong Shanghai

CeMAT Asia Exhibition will be hold from 1st to 4th Nov 2016 at Pudong Shanghai

The Latest Global Power Battery TOP10 Released!

2023-08-16 | Power Battery - Electric Forklift

The same key battery manufacturers that dominate the automotive power battery market, such as CATL, LG Energy Solution, and Panasonic, are likely at the forefront of supplying lithium-ion batteries for electric forklifts as well. As these companies continue to innovate and improve their battery technologies, the benefits will likely extend to electric forklifts, making them more reliable, efficient, and environmentally friendly.

Lithium battery forklifts are the future development trend of electric forklifts. This trend includes Hyder forklifts that use lithium batteries as a power source, and Hyder's lithium batteries are also sold separately. we can observe the significance of power battery technology in the realm of electric forklifts. Electric forklifts, as a form of new energy vehicles, also require high-performance and safe power batteries to offer sustained power supply.

Here are some points of connection between power batteries and Hyder electric forklifts:

1. Power Source for Hyder Electric Forklifts: Similar to electric cars, electric forklifts rely on power batteries to provide electricity, drive electric motors, and enable the forklifts to operate. This makes electric forklifts a cleaner and quieter option for indoor and specific outdoor environments.

2. Rising Demand and Battery Supply: With the growth of the electric forklift market, the demand for high-quality and high-efficiency power batteries is also increasing. Hyder needs to ensure sufficient battery production capacity to meet the needs of Hyder electric forklift.

3. Continual Battery Technology Improvement: Ongoing improvements in power battery technology make batteries lighter, increase energy density, and enhance charging speed. These factors are crucial for the performance and operational efficiency of electric forklifts.

4. Battery Lifespan and Maintenance Costs: Battery lifespan and maintenance costs are important considerations for electric forklift operators. Premium power batteries can offer longer lifespans, lower maintenance costs, and ensure the reliability of electric forklifts.

5. Sustainability and Environmental Considerations: Electric forklifts represent a green and environmentally friendly choice, requiring renewable energy charging and efficient power battery systems to achieve lower carbon emissions and greater sustainability.

6. Charging Infrastructure: To support the use of electric forklifts, workplaces need to establish suitable charging infrastructure. This might involve the planning and installation of charging stations to ensure the charging needs of electric forklifts are met.

In conclusion, power battery technology plays a pivotal role in the development of the electric forklift industry. With the expansion of the electric forklift market, innovations and optimizations in power battery technology will further propel the performance, reliability, and sustainability of electric forklifts.

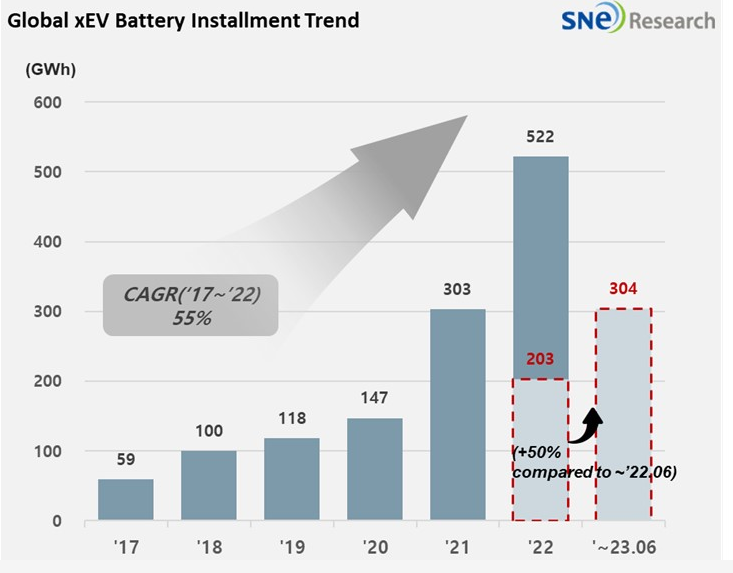

On August 3rd, market research firm SNE Research released data indicating that the global new registered electric vehicle (EV) battery installation volume for the first six months of this year reached 304.3 GWh, marking a 50.1% year-on-year growth.

The top 10 companies in terms of global EV battery installations from January to June are as follows: CATL (Contemporary Amperex Technology Co. Ltd.), BYD, LG Energy Solution, Panasonic, SK Innovation, CALB (China Aviation Lithium Battery), Samsung SDI, EVE Energy, Guoxuan High-Tech, and SVOLT.

Among these top 10 companies, the ones with the fastest growth rates in the first half of the year were all Chinese firms: EVE Energy (151.7% growth), BYD (102.4% growth), and CATL (58.8% growth).

Five companies had growth rates lower than the overall market growth rate of 50.1%. These companies were SK Innovation (16.1% growth), Guoxuan High-Tech (17.8% growth), Samsung SDI (28.2% growth), Panasonic (39.2% growth), and EVE Energy (44.9% growth).

The cumulative battery installation volume of the six Chinese companies amounted to 190.4 GWh, accounting for 62.57% of the total 304.3 GWh. Among the top 10 companies (with a cumulative volume of 285.8 GWh), these Chinese firms constituted 66.62%. This suggests that out of every 10 new energy vehicles globally, 6 are equipped with batteries from these 6 Chinese battery companies.

The combined battery installation market share of the three Korean battery manufacturers dropped by 2.2 percentage points to 23.9% compared to the previous year.

Ranked fourth, the only Japanese company in the top 10, Panasonic, saw its market share decrease from 8.1% to 7.5% year-on-year

1. CATL

CATL saw a growth of 56.2% compared to the previous year, maintaining its global market leader position as the only battery supplier with a market share exceeding 30.0%. Apart from its domestic market in China, CATL's growth in Europe and North America was nearly twice that of the previous year.

Notably, in the international market outside of China from January to May, CATL's installation volume was almost on par with the then-market leader LG Energy Solution. However, CATL has since surpassed LG Energy Solution by a significant margin of 14.6 GWh.

2. BYD

BYD achieved over double the growth compared to the same period of the previous year through vertical integration and its popularity in the new energy vehicle market. It is expanding its market share outside of China, particularly in Asia and Europe, centered around flagship model Atto 3 (Yuan +).

3. LG Energy Solution

LG Energy Solution supplies batteries for popular models like Tesla Model 3/Y, Volkswagen ID.3/4, and Ford Mustang Mach-E. As these models continue to grow in sales, LG Energy Solution is set to benefit. Moreover, overseas sales of Hyundai IONIQ 6 and Kona (SX2), equipped with LG Energy Solution batteries, are expected to expand.

4. Panasonic

Panasonic's battery usage volume for the first six months of this year reached 22.8 GWh, marking a 39.2% increase compared to the previous year. As a major supplier to Tesla, Panasonic's battery sales are significantly driven by Tesla's Model Y and other models.

5. SK Innovation

SK Innovation, with its growth driven in part by strong sales of Hyundai Ioniq 5, Kia EV6, and Mercedes EQA/B, had the lowest year-on-year growth rate among the top 10. However, it still managed to benefit from the sales of these models.

6. CALB

In June of this year, CALB had a nearly 70% penetration rate in Xiaopeng Motors' vehicles, covering all models of Xiaopeng G6. Moreover, CALB is a supplier to several other major Chinese automakers.

7. Samsung SDI

Samsung SDI's growth continues, with batteries supplied to models like Rivian R1T/S, BMW i4/7/X, and Audi e-tron. Although it's closely followed by CALB, Samsung SDI may remain in the seventh global position for some time.

8. EVE Energy

EVE Energy demonstrated extraordinary growth with a year-on-year increase of 151.7%. As of August 3rd, EVE Energy disclosed its semi-annual performance forecast, projecting a profit increase of 50.00% - 65.00% in the first half of 2023.

9. Guoxuan High-Tech

Guoxuan High-Tech has a significant presence in the logistics vehicle segment, supplying over 24,600 new energy logistics vehicles in the first half of this year.

10. SVOLT

SVOLT's battery customers include well-known new energy vehicle companies domestically and internationally. It is also preparing for the spin-off and listing of its battery business unit.

This detailed overview sheds light on the growth, market dynamics, and competitive landscape of the global EV battery industry.